- calendar_month August 31, 2022

- folder Real Estate

Rent control in Los Angeles is confusing people; especially with an ongoing state of emergency gripping the city. We witnessed this first hand when we attended the Los Angeles Housing Department’s (LAHD) Wednesday, August 24th webinar. The meeting was primarily packed with landlords as baffled as they were angry. Despite his succinct responses, host Agassi Topchian, a member of the Rent Stabilization Commission, seemed unable to assuage their fears. A steady stream of anxiety-riddled questions met him at every turn. Many more were rephrased versions of earlier questions. Topchian seemed unfazed. The closest he came to addressing the outrage was to clarify, “We don’t adopt ordinances; we enforce them.” Whether you’re a landlord or a tenant, you need to recognize the ins and outs of the rent protection Los Angeles offers. So here’s everything the LAHD broke down for us.

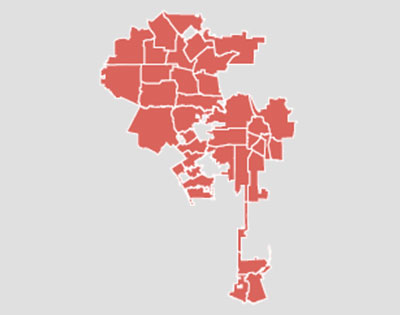

Is Your Property in Los Angeles City or Just Los Angeles County?

Photo credit: Envato

The Greater Los Angeles area is a sprawling megalopolis of vague boundaries, at least in public perception. But there is actually a very clear divide between the city of Los Angeles and Los Angeles County. And knowing where your property falls in that division is key to understanding how the rent control Los Angeles employs affects you.

LAHD directed guests to two websites that can clear up whether your property stands in Los Angeles city or county. You can either use the ZIMAS website to look up your property location or the Los Angeles Neighborhood Info site to look up your rental property. When inputting your property’s address, refrain from using the city, state, or zipcode. If no results are returned, then your property is not considered part of the city of Los Angeles. It is most likely part of LA County only.

Topchian recommended those with property outside of the city to contact the county about the guidelines for rent control Los Angeles County offers. Property owners can simply call them at (833) 223-RENT or through the rent destabilization section of the LA County website.

Understanding the City’s Rent Stabilization Ordinance

Professionals recognize the safeguard that we colloquially refer to as “rent control” by its official title: the “Rent Stabilization Ordinance” (RSO). The city of Los Angeles must incorporate a property for it to adopt RSO protections. RSO protections do not encompass property standing within Los Angeles County but not within the city of LA. It may still have some rent stabilization protections under state laws, but we’ll get to that in a bit.

Photo credit: Los Angeles City Planning

The law demands that landlords of RSO-subjected properties keep a certificate of residency on file bearing a date no later than October 1st, 1978. However, landlords who own Ellis Act -subjected property with a construction date post-July 16th, 2007 should contact an attorney for further clarification.

As a tenant of an RSO property in Los Angeles, what kind of protections can you expect?

- Annual rent increases are stabilized to a certain percentage

- Legal reasons must be provided for evictions (these include both tenant at-fault and no-fault evictions)

- Relocation assistance must be provided for tenant no-fault evictions

Is Your Property Subject to the Rent Control Los Angeles City Offers?

Currently, the city of Los Angeles is host to an estimated 118,000 rent controlled properties comprising approximately 640,000 RSO units.

It doesn’t matter who owns a property under RSO protections. Whether the property is part of a Trust or sold to a new owner, RSO protections remain in place.

If you’re still unsure whether your property benefits from the rent control Los Angeles city offers, you can find out with a text. You can start by simply texting “RSO” to 855-880-7638.

How the City’s Emergency Order Impacts RSO Properties

Photo credit: Envato

Most landlords are familiar with RSO protections in Los Angeles. But a lot of those protections became unclear when the city went into a state of emergency in early 2020. Since then, many landlords have felt like they entered some sort of limbo. But even tenants enjoying RSO regulations have admitted to confusion about the details.

During the webinar, Topchian kept returning to a point with which many landlords seemed to struggle. Property owners cannot institute rent increases on RSO units until one year after the civic emergency order lifts. And that emergency order is still in place. During the questions portion of the meeting, it seemed every other question came from a frustrated landlord asking when the emergency order will lift. The answer? No one knows for sure. LAHD made it clear they don’t make this decision. But the emergency order is currently still in place. This means that landlords still have at least a year to go before they can raise rents on any RSO properties. But Topchian promised that when the emergency restrictions lift, landlords will definitely hear about it.

RSO guidelines also prevent landlords from charging interest or late fees on unpaid rent for residential tenants. So what can a landlord do? While the answers didn’t do much to reduce the panic and anger in the Zoom chat box, an answer came nonetheless.

Ways Landlords Can Increase Rent Even Amidst Emergency Restrictions

Landlords still retain the right to:

- Collect RSO and Systematic Code Enforcement Program (SCEP) surcharges at any time (after providing proper notice to tenants) – more on this below

- Secure a “just and reasonable” rent increase at any time when approved by special permission of the LAHD (after providing proper notice to tenants)

- Collect cost recovery rent increases when approved by the LAHD

Photo credit: Envato

But landlords shouldn’t get their hopes up too high. RSO and SCEP surcharges amount to mere dollars a month. And approval of “just and reasonable” and cost recovery increases are rare. Landlords tempted to make a pricey repair and pass the cost directly onto tenants should pause. In order for such a rent increase to be approved by the LAHD, the landlord must submit a formal application and await LAHD approval. Even then, the increase can’t be applied until one year after the emergency restrictions are lifted.

The most common programs involving cost recovery rent increases include:

- Primary Renovation Program

- Seismic Retrofit

- Capital Improvement Program

- Rehabilitation Work Program

- Just and Reasonable Rent Increase (NOI Review)

- Luxury Exemption Certificate Program

Applications can be submitted online through LAHD’s online service page or through their cost recovery programs page.

Landlords Desperately Seeking Exceptions

Landlords presented a laundry list of potential exceptions which Topchian summarily shut down. One example cited a property constructed prior to 1978 in the city of LA that had been extensively remodeled. Extra space had even been added. Topchian recommended the landlord seek legal counsel. Yet, he suspected that if the pre-1978 structure still existed in any way, the RSO restrictions would remain firmly in place.

Another landlord offered an example of an inherited property with rent below the current market value due to RSO restrictions during the emergency period. This was the only example that prompted Topchian to pause. He suggested the property owner consider filing an application for a just and reasonable rent increase.

Photo credit: Envato

Several landlords repeated questions about unpaid rent, evictions for renovation purposes, or emergency rent increases to recoup losses. Topchian met these inquiries with a harder edge. Landlords are strictly prevented from evicting tenants due to non-payment if their situation relates in any way to the COVID-19 pandemic. Even once the emergency restrictions have passed, landlords are not permitted to adjust rental rates as a means of recouping losses. And in most cases, landlords can’t evict tenants for the purposes of renovation without covering costly relocation fees. However, here Topchian deferred to code enforcement inspectors who can be reached at 866-577-7368.

The Registration Responsibilities for Landlords

While landlords may be questioning the benefits of multi-unit investment, they still have certain responsibilities for RSO units. Chief among these is annual registration of the units that offer the rent control Los Angeles tenants rely upon. Registration for RSO units includes both payment of the annual bill and completion of the rent registry form. The deadline to register RSO units is always the last day in February of every year.

However, the modest registration fees can be shared with tenants. Furthermore, they are not subject to the normal waiting period of a year following the lifting of the emergency restrictions. Landlords can basically pass on 50% of the registration fees to their tenants, but these must be meted out over a 12-month period. These registration fees are split into the aforementioned RSO and SCEP fees.

In 2022, the RSO fee per unit is $38.75. Cut in half and dispersed over a 12-month period, this fee equates to $1.61 per month per unit. The SCEP fee is slightly more substantial at $67.94 per unit. Again, trimmed in half and divided over 12 months, the fee equates to $2.83 per month per unit.

Photo credit: Envato

In order to collect this monthly amount from the tenant, a landlord must provide proof that the fees were paid along with a request for payment to the tenant. Landlords can issue their 30-day notice to collect payment at any time, regardless of emergency restrictions. However, the amount cannot be requested as a lump sum. It must be divided in even increments over the 12-month period.

California State Rent Controlled Properties

As part of AB-1482, the Tenants Protection Act of 2019, certain units not protected by RSO are instead protected by state law. AB-1482 went into effect on January 1st, 2020. Under AB-1482, annual rent increases are limited to no more than 5% plus the percentage change in the property region’s cost of living or 10%. The law defers to the lowest of the two. From August 1, 2021 to July 31, 2022, the Los Angeles area’s change in cost of living was 8.6%. Adding this to the pre-established 5%, the result would be a 13.6% increase. However, since this exceeds the 10% limitation, it would automatically reduce to 10%.

AB-1482 may or may not apply to stand-alone single family homes or condominiums. Topchian recommended seeking legal advice if you’re uncertain whether your property is regulated by AB-1482.

Contacting the LAHD with Further Inquiries

Topchian wrapped up the LAHD’s webinar clarifying rent control Los Angeles properties offer by providing contact information. Judging by the amount of questions and angry sentiments that continued clogging the chat box, landlords will be heavily using these resources in the coming weeks.

Photo credit: Envato

You can submit a question any time through the LAHD website.

Need to report a violation of the rent control Los Angeles offers? You can either contact the LAHD hotline at 1-866-577-RENT or reach out through their website to lodge a complaint.

Just need to brush up on the rent control Los Angeles city residents enjoy? You can do so through LAHD’s dedicated COVID-19 Renter Protections page.

And if you’re that rare landlord who has a property not protected by RSO or AB-1482? Topchian recommends consulting with an attorney to determine by how much you can reasonably increase your tenant’s rent.

What if You Wanted to Sell Your Property?

If you’re like the landlords who made up an overwhelming percentage of attendants for Wednesday’s webinar, none of this information is much comfort. Most landlords will still need to tread water through at least another year of restrictions. Of course, there is an alternative for landlords who can’t take another month of losses: selling your property. You’re probably asking yourself, “What lunatic is buying tenant-occupied property in these conditions?” But the answer’s simple: organizations with the resources to absorb those losses.

One such organization is @HomeOffer. They’ll buy your property, tenants or no, for all cash. It might sound too good to be true, especially after the clarifications from LAHD. But you can contact them now and receive a no obligation all-cash offer in as little as four hours. At the very least, it’s not a bad safety net to have.